is oregon 529 college savings plan tax deductible

A 529 plan can be a great alternative to a private student loan. Oregon 529 Tax Deduction will sometimes glitch and take you a long time to try different solutions.

Oregon College Savings Plan Transition Still Rocky For Some Oregonlive Com

Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions.

. Oregon families can take tax credits worth up to 300. Oregon 529 Tax Rules will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Oregon 529 Deductions quickly and handle each specific.

LoginAsk is here to help you access Oregon 529 Deduction By Year quickly and handle each specific case you encounter. When you invest with the Oregon College Savings Plan your account has the chance to grow and earn interest tax-free. Oregon 529 College Savings Network and ABLE account contributions.

LoginAsk is here to help you access Oregon 529 Tax Rules quickly and handle each specific. And unlike other investment. You do not need to.

All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. Tax Benefits of the Oregon 529 Plan. Help users access the login page while offering essential notes during the login process.

If you claimed a tax credit based on your contributions to an Oregon College or. Trying to determine if I will get tax deductible from rollover the funds from Texas College Savings Plan to Oregon College Savings Plan. As a result many families may be missing out on a.

You can deduct up to a maximum of 4865 per year. If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings.

Starting January 1 2020 Oregon will be the first state in the nation to offer a refundable tax credit for contributions made to its 529 College Savings Plan. Families who invest in 529 plans may be eligible for tax deductions. The detailed information for Oregon 529 Plan Deduction 2020 is provided.

The Oregon College Savings Plan offers several exclusive benefits for Beaver State residents. Furthermore you can find the. Although contributions arent tax-deductible the earnings in a 529 account arent subject to tax treatment by the state or federal government when theyre used to pay for.

This article will explain the tax deduction rules. Oregon 529 Deductions will sometimes glitch and take you a long time to try different solutions. Oregon has its own state-operated 529 plan.

Furthermore you can find the Troubleshooting Login Issues. One study even found that when the federal tax benefits were taken into consideration 529 plans outperformed their benchmarks in every category. Oregon College Savings.

Texas has no state income tax so I was unable to get tax. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. LoginAsk is here to help you access Oregon 529 Tax Deduction quickly and handle.

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. 2 days ago529 plans tax-advantaged investment vehicles meant to help families save for college are often misunderstood. So what starts small grows over time.

Oregon College Savings Plan Tax Deduction LoginAsk is here to help you access Oregon College Savings Plan Tax Deduction quickly and handle each specific case you encounter. On the STATE TAXES tab clicking the Learn more link next to Oregon College MFS 529 Savings Plan and ABLE account Deposits reads. Oregon Deduction For 529 Plan LoginAsk is here to help you access Oregon Deduction For 529 Plan quickly and handle each specific case you encounter.

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

Florida 529 Plans Learn The Basics Get 30 Free For College Savings

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

5 Mistakes To Avoid When Saving For College In A 529 Plan Money

529 Plan State Tax Fee Comparison Calculator 529 Plans Nuveen

How Much Are 529 Plans Tax Benefits Worth Morningstar

9 Benefits Of A 529 Plan District Capital

What Are The 529 Plan Contribution Limits For 2022 Smartasset

529 Plan Maximum Contribution Limits By State Forbes Advisor

About The Plan Oregon College Savings Plan

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

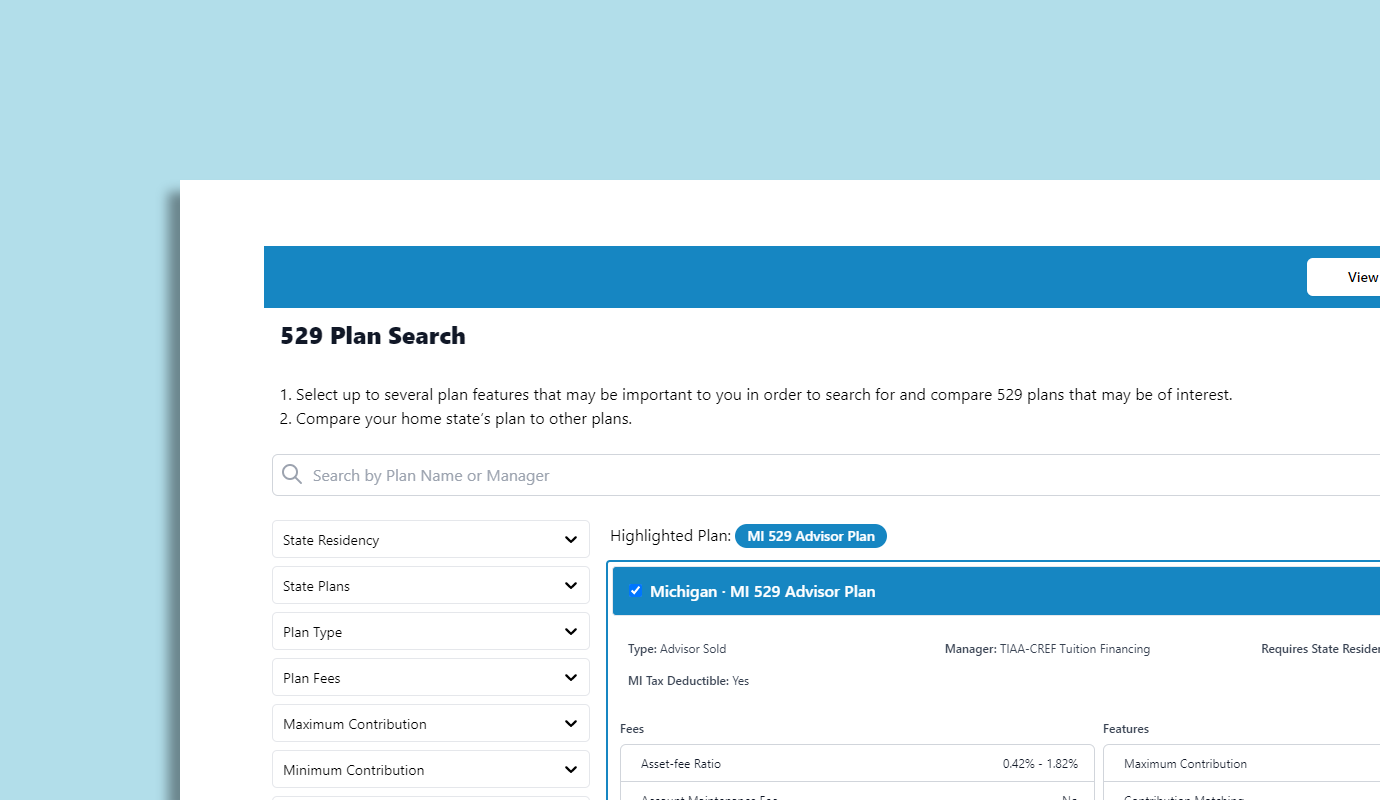

529 Comparison Search Tool 529 Plans Nuveen

The Benefits Of 529 College Savings Plans

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

529 Plan Advertisements And Marketing Collateral

Managing Your Account Oregon College Savings Plan

529 Plan State Tax Deduction Limits And How To Choose A 529 Plan And Save Now For Future College Costs Prepaid Vs College Tax Savings Plan Aving To Invest

Tax Benefits Oregon College Savings Plan

Texas College Savings Plan Texas 529 College Savings Plan Ratings Tax Benefits Fees And Performance